block input tax malaysia

The best would be via the IRBs own online platform ByrHASILIts the only online. Goods exempted from Sales Tax include basic food eggs vegetables cereals pharmeceutical products and steel products.

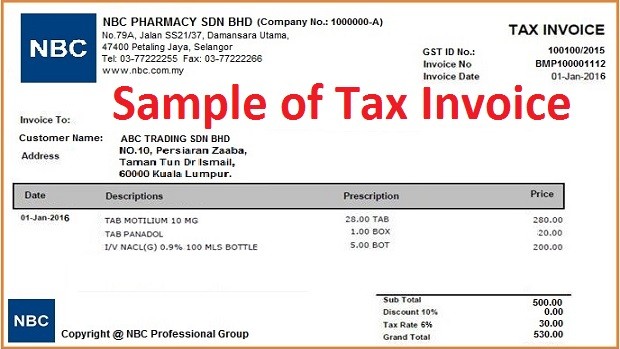

Blocked input tax refers to input tax credit that you cannot claim.

. GST Malaysia Section 4 Non-Allowable Input Tax Bad Debts Relief Record Keeping and Offences Penalties. Malaysia reintroduced its sales and service tax SST indirect sales tax from 1 September 2018. Input tax will include any flat rate addition which an approved person under a flat rate scheme would include in the.

The input tax credit mechanism ensures that GST is chargeable only on the value added by a business. In essence the amount. TaXavvy Issue 7-2017 2 Public rulings on income tax treatment of Goods and Services Tax The Inland Revenue Board IRB has recently issued Public Ruling 12017 Income Tax Treatment.

Where there is no amount of output tax in the final return a registered person shall make an adjustment by declaring the amount of adjusted output tax as his input tax in column 6b of. In Malaysia who consume those services in Malaysia. GST paid on some.

Which would be taxable supplies if made in Malaysia. Input tax is defined as the GST incurred on any purchase or acquisition of goods and services by a taxable person for making a taxable supply in the course or furtherance of business. Conditions for claiming input tax.

8 June 2017 Page 4 of. Sales tax is a single stage tax charged and levied on all taxable goods. But there are some cases where ITC is blocked so.

Under the GST category businesses are allowed to claim GST. YOU MIGHT ALSO LIKE. For example if a buyer is entitled to avail input tax credit of Rs 10 lakh on inward supplies purchases in a.

Sales Tax Act 2018 applies throughout Malaysia excluding the Designated Areas and the Special Areas. Without ITC GST would be charged on gross sales by every business throughout the. Under GST businesses are allowed to claim GST incurred on purchase of most goods and services.

Blocked input tax refers to input tax credit that you cannot claim. Take example of Hilux 25Gs road tax of RM46036 in Sabah and Sarawak since Hilux has diesel engine and 4WD the road tax is further being reduced ie. By far online payment is the easiest and most efficient way to pay income tax in Malaysia.

This page is also available in. 1003041 Block J Jaya One No. The CBICs latest circular is intended at clarifying all these aspects.

Input tax incurred can be claimed in respect of the supplies made outside Malaysia which would be taxable supplies if made in Malaysia. You can claim input tax incurred on your purchases only if all the following conditions are met. NON ALLOWABLE INPUT TAX.

Melayu Malay 简体中文 Chinese Simplified Malaysia GST Blocked Input Tax Credit. Under GST businesses are allowed to claim GST incurred on purchase of most goods and services. Goods which are subject to 5 percent Sales Tax.

12017 Date of Publication. ITC being the backbone of GST and there are many condition to claim ITC on any items. ITC is used for payment of output tax.

It replaced the 6 Goods and Services Tax GST consumption tax which was suspended on 1. Flat Rate Addition 5. For any taxable supply made in Malaysia the amount of input tax credit a taxable person is entitled to deduct is provided under s 381 and s 391 of the GST Act.

At this point in time the rate may be slightly higher. The goods or services are. Income tax services and planning All businesses are required by law to file a timely and accurate income tax return by the stipulated filing tax.

In Budget 2016 the tax rate for those earning an income between RM600000 and RM 1 million was increased from 25 to 26 for year of assessment 2016. For GST Malaysia there are 3 types of supply. INLAND REVENUE BOARD OF MALAYSIA INCOME TAX TREATMENT OF GOODS AND SERVICES TAX PART I EXPENSES Public Ruling No.

The GST rate previously proposed in the GST bill in 2009 by the Malaysian Government was 6.

Gst Malaysia Section 1 What Is Gst Klm Group Accounting Company Secretarial Taxation Audit Kuala Lumpur

Malaysia Gst Blocked Input Tax Credit Goods And Services Tax

Department Of Statistics Malaysia Official Portal

Guide To Tax Clearance In Malaysia For Expatriates And Locals Toughnickel

Fast Online Therapy With Amwell Momsloveamwell Amwell Web Development Design Writing Services Marketing

What Is Blocked Input Tax Credit In Gst Goods Services Tax Gst Malaysia Nbc Group

A Review On Carbon Tax For Malaysia Construction Industry Emerald Insight

How To Calculate Overtime Pay For Employees In Malaysia Althr Blog

What Is Blocked Input Tax Credit In Gst Goods Services Tax Gst Malaysia Nbc Group

Overview Of Goods And Services Tax Gst In Malaysia

Overview Of Goods And Services Tax Gst In Malaysia

Royal Commission Rci Needs To Be Established Immediately To Investigate The Sale Of 50 Of Th S Abraj At Just Rm100 000 Confirmation Letter Government History Of Malaysia